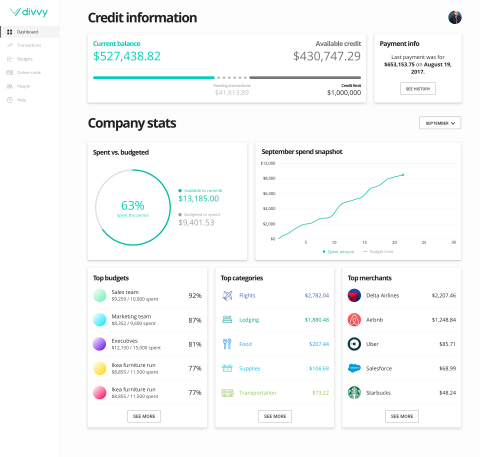

"Since the PPP program is first come, first serve, we knew we'd need a banking partner who could process lots of loans quickly, without applications getting stuck. "Cross River Bank has been an incredible partner," said Snow. For small businesses struggling to keep the lights on or retain employees during the COVID-19 crisis, speed to funding is the top priority. In the first five hours of accepting applications, Divvy processed over $800 million of loan requests. "We're seeing customers take their applications from start to finish in 15 minutes."ĭivvy partnered with Cross River Bank due to CRB's tech-first approach-many other banks have been processing applications on paper. "This is the fastest, easiest solution for PPP applications available today, because it all takes place online," said Sterling Snow, Senior Vice President of Revenue at Divvy. We believe everyone in America should be able to own a home.LEHI, Utah, Ap/PRNewswire/ - Divvy, the leader in spend and expense management, today announced the immediate availability of its 100%-digital application for SBA-backed Paycheck Protection Program (PPP) loans, through its partnership with Cross River Bank (CRB).

Divvy is delivering something entirely new, something that we are immensely proud of and something that we know in our hearts will change the real estate landscape forever. It’s natural for new systems like Divvy to come with some confusion and misconceptions. So even if payments seem higher now on paper, once you do the math, you will see that in the long run saving a down payment quickly is the smart way to go. What’s more, a more substantial down payment means you are opening yourself to more mortgage options: a fixed rate versus adjustable, better loan terms, etc. More down payments means you can apply for a mortgage loan sooner, and a strong mortgage loan equates to lower payments in the long run. You are building a 10% down payment over just 3 years – that’s a very accelerated savings rate! Sometimes our payments are higher than rent, but that’s because the extra dollars go straight to your future down payment. Divvy is considerably more expensive than renting.ĭivvy helps you save up for a down payment. You’re sharing selling costs and appreciation gain, just like anyone who puts funds into real estate.ģ. Divvy deducts 1.5% in order to cover the selling costs. What’s more, your cash out will be based on the home’s new and possibly appreciated price, not it’s original price. If you choose not to buy your house, you can still cash out your down payment savings. Whereas other rent-to-own agreements force customers to lose out on any capital investments if they do not purchase the property, Divvy is centered on a cash out system.

This has been a traditional complaint with the rent-to-own industry, but remember, Divvy has completely changed the system. I will lose a ton of money if I never buy. We’ll make a strong all-cash offer on the home you choose.Ģ. We’re here to back you up during this process. We are on your side, and we want to do everything in our power to negotiate the lowest price, pick the best home for you and inspect it carefully. In the regions we operate in currently, that accounts for 90%+ of all homes, meaning our buyers have thousands and thousands of choices available to them.įurther, this system actually creates an enormous advantage for the buyer because it means that Divvy is buying a home specifically for you. With Divvy, you can choose from nearly any home on the market between $60,000 and $300,000. Here are the top 3 misconceptions about the Divvy rent to own program. We find that many people are surprised when they first hear how Divvy works. That’s why Divvy has fought so hard to put a new spin on things, reshaping the way we think both about renting and owning.īut like all great new things, change can seem a little confusing at first. But the truth is, complacency is never good for consumers, and the status quo needed a shaking up. For decades, the rental and homeownership market has been run by business as usual.

0 kommentar(er)

0 kommentar(er)